What is GST Registration?

GST registration is the process of obtaining a unique identification number for a business subject to Goods and Services Tax (GST). According to the Central Goods and Services Tax Act, 2017, businesses with an annual turnover of more than Rs 40 lakh (Rs 20 lakh in some states) are required to collect tax. GSTIN (Goods and Services Tax Identification Number), commonly known as GST number in India, consists of 15 digits. These numbers are unique to each taxpayer and act as a tax identification number. This ID supports the sharing of all transactions and business-related information with the authorities. It replaces VAT and other taxes. GST registration refers to the process of registering a company under the GST Act 2017. All e-commerce merchants need to register for GST. Citizens can apply for the new GST online without going to any government office. The registration process can be initiated from the GST portal. The portal will generate the ARN status immediately after submitting the GST application.

Benefits of Registering for GST

Registering for Goods and Services Tax (GST) offers several benefits for businesses, including:

Legal Recognition: GST registration provides legal recognition to your business, enhancing credibility with customers and suppliers.

Input Tax Credit (ITC): Registered businesses can claim ITC on the taxes paid for inputs, reducing overall tax liability.

Seamless Supply Chain: GST promotes a unified tax structure, making inter-state transactions smoother and eliminating the cascading effect of taxes.

Compliance Benefits: It simplifies tax compliance, with standardized processes for filing returns and paying taxes.

Enhanced Business Opportunities: Many government contracts and tenders require GST registration, opening up more business opportunities.

Easier Access to Credit: Lenders often prefer dealing with GST-registered businesses, as registration indicates a level of legitimacy and compliance.

Boost to Exports: Exporters can claim refunds on the GST paid on inputs, making their products more competitive in global markets.

Documents Required for GST Registration

To register for GST, you’ll typically need the following documents:

PAN Card: The Permanent Account Number (PAN) of the business owner or the company.

Proof of Business Registration: This can include documents like a partnership deed, certificate of incorporation, or any other relevant registration proof.

Identity and Address Proof: This can include:

- Aadhar card

- Passport

- Voter ID

- Driving license

- Any government-issued ID

Business Address Proof: Documents that can serve as proof of business location, such as:

- Utility bills (electricity, water, etc.)

- Lease agreement or rental agreement

- Sale deed

Bank Account Statement: A copy of the bank statement or a canceled cheque with the business name.

Photographs: Passport-sized photographs of the business owner or partners.

Authorization Document: If someone else is applying on your behalf, you’ll need an authorization letter.

Digital Signature: For companies and LLPs, a digital signature is often required.

GST Registration Eligibility and Threshold Limits

GST registration eligibility and threshold limits can vary based on the type of supply and the location of the business. Here are the key points:

1. Threshold Limits for GST Registration

Turnover Limits:

- For Goods:

- ₹40 lakhs for most states.

- ₹20 lakhs for special category states (Northeast states, Jammu and Kashmir).

- For Services:

- ₹20 lakhs for most states.

- ₹10 lakhs for special category states.

- For Goods:

E-commerce Sellers: Regardless of turnover, e-commerce operators must register for GST.

Inter-State Supply: Any business engaging in inter-state supply must register, regardless of turnover.

2. Eligibility for GST Registration

- Business Structure: Individuals, partnerships, companies, and other legal entities can register.

- Location: Any business operating in India can apply, subject to threshold limits.

- Exemptions: Certain categories (like small-scale industries or specific agricultural activities) may be exempt from registration.

- Voluntary Registration: Businesses can opt for voluntary registration even if their turnover is below the threshold limits.

3. Mandatory Registration Situations

- Casual Taxable Person: If you engage in occasional sales or activities.

- Non-Resident Taxable Person: Non-residents supplying goods/services in India must register.

- Input Service Distributor (ISD): Entities distributing input tax credits.

Step-by-Step Guide For GST Registration Process

Step 1: Visit the GST Portal

- Go to the official GST portal: gst.gov.in.

Step 2: Select ‘New Registration’

- Click on the “Services” tab, then navigate to “Registration” and select “New Registration.”

Step 3: Fill in the Basic Details

- Select the type of taxpayer (e.g., individual, partnership, company).

- Enter details like name, PAN, email address, and mobile number.

- Click “Proceed” to receive an OTP on your mobile and email.

Step 4: Verify OTP

- Enter the OTP received on your mobile and email for verification.

Step 5: Receive TRN

- After verification, you will receive a Temporary Reference Number (TRN) on your screen. Note it down for future reference.

Step 6: Complete the Application

- Go back to the GST portal and select “Register” under the “Services” tab.

- Choose “Temporary Reference Number” and enter the TRN.

- Click on “Proceed” to access your application.

Step 7: Fill in the Application Form (GST REG-01)

- Complete the application form by providing the following details:

- Business details (type of business, address, etc.)

- Bank account details

- HSN/SAC codes for goods/services

- Authorized signatory details

Step 8: Upload Required Documents

- Upload the necessary documents, which may include:

- PAN card

- Proof of business registration

- Identity and address proof

- Bank statement/cancelled cheque

- Address proof of the business

Step 9: Submit the Application

- After filling in all details and uploading documents, submit the application.

Step 10: ARN Generation

- Once submitted, you will receive an Application Reference Number (ARN) via email and SMS. Keep this for tracking your application status.

Step 11: GST Officer Review

- The GST department will review your application. If everything is in order, you will receive your GST registration certificate.

Different Categories Which Requires GST Registration

Goods and Services Tax (GST) registration is required for various categories of businesses and entities in India. Here are the primary categories that require GST registration:

Aggregate Turnover:

- Businesses with an aggregate turnover exceeding ₹20 lakhs (₹10 lakhs for special category states) in a financial year.

Inter-State Supply:

- Suppliers making inter-state supplies of goods or services, regardless of turnover.

E-commerce Operators:

- Entities providing services through e-commerce platforms or marketplaces.

Casual Taxable Persons:

- Individuals or entities making occasional supplies without a fixed place of business.

Non-Resident Taxable Persons:

- Foreign entities supplying goods or services in India.

Liability to Pay Tax:

- Businesses required to pay tax under reverse charge mechanism.

Input Service Distributors:

- Businesses distributing credit of input services.

Agents and Brokers:

- Those acting as agents for supply of goods or services.

Franchisees and Licensors:

- Entities providing franchise services or licenses for trademarks.

Manufacturers:

- Those engaged in the manufacture of goods, even if below the turnover threshold in some cases.

Service Providers:

- Businesses providing taxable services if their turnover exceeds the threshold limit.

Registered Dealers:

- Dealers registered under the previous tax regimes (VAT, Excise) may need to register under GST.

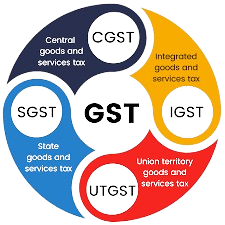

Types of GST Registration

Central Goods and Services Tax (CGST) is levied on goods and services within a state

State Goods and Services Tax (SGST) is levied on the sale of goods or services to a state

Integrated Goods and Services Tax (IGST) is levied on businesses that supply goods and services across state borders

Federal Goods and Services Tax (UTGST) is levied on goods and services supplied in the Union Territories of Andaman and Nicobar Islands, Daman and Diu, Dadra and Nagar Haveli, Lakshadweep and Chandigarh. UTGST is charged along with CGST

What is Form GST Reg 01?

Form GST REG-01 is an application for registration under Goods and Services Tax (GST). Anyone who wants to register for GST needs to submit this. This form is submitted by taxpayers who have recently registered to receive ITC under GST5. This form needs to be submitted to receive ITC on shares. It needs to be provided online to persons required to withhold property tax under section 51, persons required to collect property tax under section 52 and individuals, excluding non-resident taxpayers.

Advantages for Businesses with GST Registration

GST registration has many benefits for businesses, including creating a legal status and ensuring compliance with tax laws:

Registered businesses can claim Input Tax Credit (ITC), thus reducing their total tax liability and availing the benefits of a common tax. Benefits of Doing Business in Government

Online filing and payment process saves time and reduces paperwork; tax time is extended to avoid businesses until their income crosses the threshold.

GST registration increases confidence, provides access to a wider market and promotes competitive advantage.

Strengthens the supply chain, supports legal protection and makes the process reversible, creating a transparent and efficient business environment in India.

GST Registration FAQs

Businesses with an aggregate turnover exceeding ₹20 lakhs (₹10 lakhs for special category states) need to register. Additionally, inter-state suppliers, e-commerce operators, and casual taxable persons must also register, regardless of turnover.

Registered businesses can collect GST from customers, claim input tax credits, and enhance credibility with clients and suppliers.

You can apply online through the GST Portal. You'll need to provide necessary documents like PAN, proof of business address, and bank account details.

Common documents include:

- PAN of the business

- Proof of business registration (like a partnership deed or incorporation certificate)

- Identity and address proof of the applicant

- Bank account statement/cancelled cheque

- Business address proof (electricity bill, lease agreement, etc.)

No, there is no fee for obtaining GST registration.

Typically, GST registration is processed within 3-7 working days. However, if additional information is required, it may take longer.

Yes, you can apply for cancellation of your GST registration on the GST Portal if you cease to operate, change the business structure, or for other valid reasons.

GST registration is valid as long as the business is operational and complies with GST laws. It must be renewed if any details change.

Failure to register when required can result in penalties, fines, and the inability to collect GST from customers.

Yes, small businesses below the turnover threshold can operate without GST registration, but they won't be able to collect GST or claim input tax credits.